In today’s digital era, e-invoices have become key to ensuring transparent and efficient financial transactions. This guide is designed to help local Malaysians, business owners and corporations understand the essentials of e-invoicing.

By the end of this guide, you will have the knowledge to streamline your invoicing processes while complying with Malaysian regulations.

What is an E-Invoice?

An e-invoice is a digital version of the traditional paper invoice, generated and stored electronically.

In Malaysia, e-invoices adhere to the guidelines set by LHDN/IRBM (Inland Revenue Board of Malaysia). They must include accurate details such as the supplier’s name, Tax Identification Number (TIN), address and contact information.

This system replaces manual paperwork, helping businesses reduce errors, speed up processing and ensure regulatory compliance.

E-Invoice vs. Tax Invoice: What’s the Difference?

E-Invoice

Format: Digital

Purpose: Facilitates electronic submission and storage

Requirement: Must meet LHDN’s specific guidelines for digital documentation

Tax Invoice

Format: Can be paper-based or digital

Purpose: Serves as evidence for claiming tax deductions

Requirement: Contains statutory information to support tax claims

The Importance of E-Invoicing in Malaysia

E-invoicing plays a crucial role for both businesses and tax claimants. Here’s why:

| Aspect | Manual Invoicing | E-Invoicing |

| Accuracy | Prone to human error | Automated data entry minimizes mistakes |

| Processing Time | Time-consuming, delays in submission | Faster issuance and processing |

| Compliance | Risk of non-compliance with tax regulations | Meets LHDN guidelines, reducing penalties |

| Storage & Retrieval | Requires physical storage space | Easy digital storage and retrieval |

| Tax Claim Efficiency | May lead to rejected claims if details are wrong | Streamlined process for claiming tax deductions |

E-invoicing not only boosts operational efficiency but also ensures that businesses can confidently claim allowable expenses when submitting their taxes.

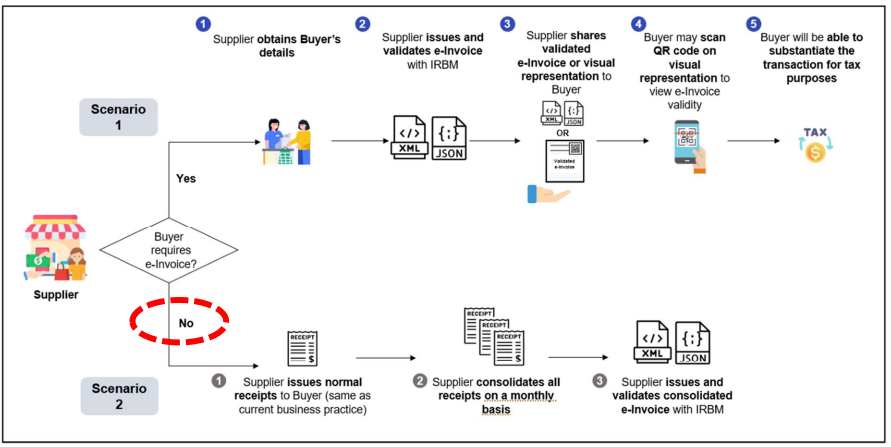

How to Claim an E-Invoice

Claiming an e-invoice involves a clear process to ensure that all details are accurate and compliant with LHDN regulations. Follow these steps:

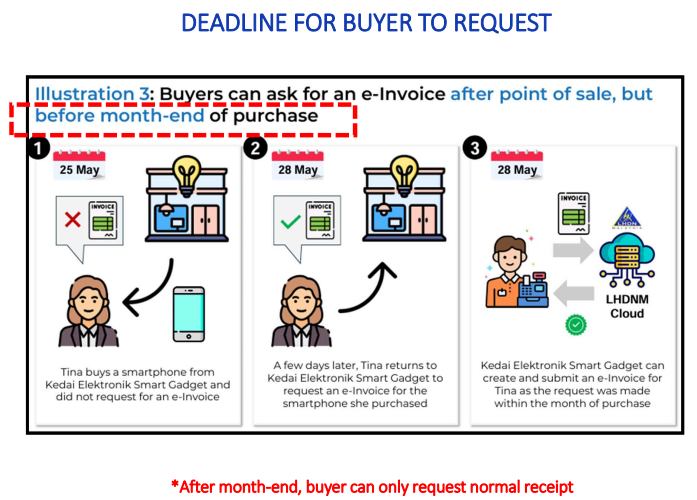

Request an E-Invoice:

Verify with your supplier whether an e-invoice is required. For corporate or high-value transactions, confirm with a simple query such as “Do you need an e-invoice?”

Collect Necessary Information:

Ensure you obtain all essential details from the supplier, including name, TIN, address, and contact number.

For staff claims, confirm that the e-invoice is issued under the appropriate entity details.

Submit to Finance:

Forward the e-invoice along with any supporting documents to your Finance department.

Adhere to the month-end submission deadline, otherwise, only normal receipts may be issued.

Final Submission to LHDN:

Once verified, the Finance team will consolidate and submit the e-invoices to LHDN to facilitate your tax claims.

Following these steps will help ensure your expenses are accurately documented and fully compliant for tax deduction purposes.

Frequently Asked Questions (FAQ) About E-Invoices

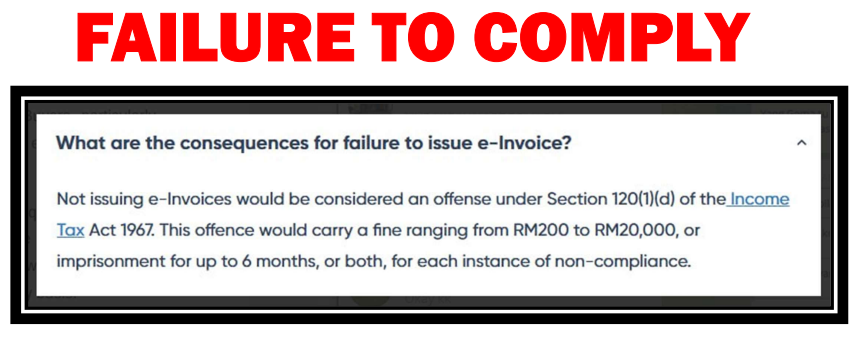

– What happens if a supplier fails to issue an e-invoice?

– What are the main challenges businesses may face when transitioning to e-invoicing?

Transitioning from traditional invoicing to a digital system often requires integrating new software with existing accounting platforms, training staff on the new processes, and ensuring data accuracy to meet strict LHDN guidelines.

Initial setup and potential system compatibility issues can be challenging, but the long-term benefits of automation and improved compliance outweigh these hurdles.

– What are the transmission mechanisms available to transmit e-invoices?

IRBM has provided two (2) e-invoice transmission mechanisms:

- Through the MyInvois Portal provided by IRBM

- Application Programming Interfaces (API)

– Is e-invoice applicable to transactions in Malaysia only?

No, the issuance of e-invoices is not limited to only transactions within Malaysia. It is also applicable for cross-border transactions.

– Are all businesses required to issue e-invoices applicable to transactions in Malaysia only?

Yes, all taxpayers undertaking commercial activities in Malaysia are required to issue e-invoices, following the phased mandatory implementation timeline.

MyFundAction, an approved organization by IRBM, offers you a seamless way to support charitable causes while ensuring compliance with e-invoicing regulations.

By contributing to our campaigns, you not only make a powerful impact in Malaysia but also ensure that your donations are properly documented through e-invoices, enabling you to claim your tax deductions with ease.

As an IRBM-approved organization, MyFundAction offers a secure way to contribute while providing e-invoices for your records. Our various campaigns empower charitable causes across Malaysia, ensuring you can confidently claim your tax deduction benefits as a taxpayer.