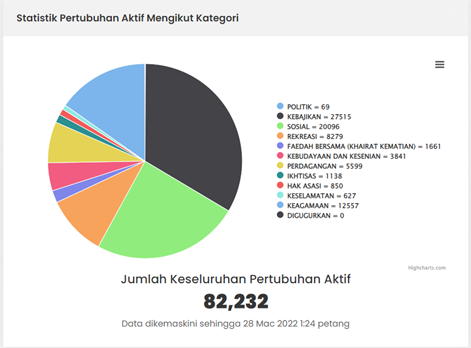

Giving is a form of gift that you show support morally or financially towards someone in need or to the charity bodies that you feel trusted. In Malaysia, there are about 82,232 legally non-profit registered with the Registrar of Society (ROS) under the Ministry of Internal Affairs of Malaysia. Out of these numbers, 33.4% or 27,483 are registered as non-profit under the welfare/charity category and MyFundAction falls under this category.

Statistics of Active NGOs by Category in Malaysia

Giving decisions is sometimes made by your feelings most of the time due to emotional attachment to the story about the unfortunate one. We don’t bother to whom we give (say we give RM10 to a charity) is a wrong perception because regardless of whatever amount we give, it is still contributing to the life of the needy; our community as a whole. As a funder, we need to know and see the impact on society and thus giving to WHOM is very important now.

Below are 4 tips on giving securely to non-profits:-

- Experienced and Expert in the Field

The first tip is to give to the non-profit that has experience and expertise in the field. Meaning to say, this kind of non-profit has capabilities to handle its operation performed by a trained team in terms of performing its assessment to every application, doing aid distribution to the community, finding potential areas or communities that need our assistance, etc. There are many things to do but this cannot be possible done by a one-man-show. With the big scale of distributions locally or internationally, non-profits will look for partners to implement aid distribution in areas where they are not physically present or registered in that country.

In terms of funding, of course, non-profits need to have a very strong funding mechanism. In MyFundAction, we actively monitor our funding target and produce campaign contents that are engaging, fun, and simple. With that effort, we can serve people in need with the allocated budget and eventually portray the impact on society. Other than that, we are also looking for partner collaborations such as GLC, MNC, SME, and NGO who intend to do their Corporate Social Responsibilities program for their employees with non-profit.

- Equitable and just

Every ringgit of your giving, non-profit should match the funding with the need of the beneficiaries. In some campaigns, there are circumstances, the funding is more than the need of the course. Therefore, non-profits should know how to manage the access fund. For example, in a health campaign, the collection can reach RM100,000 but then the need of the course is just RM50,000. The extra RM50,000 will be placed under Health Fund for future usage for other unfortunate patients. What happens if the funding is not enough for a specific campaign? Well, if that situation happens, we will fund the course partially based on whatever has been pledged.

- Efficiently and effectively managing the cost

As a non-profit, the management should own skills in managing the cost-efficient and effective by examining the procurement activities. This is also formed part of the compliance and governance of the non-profit to ensure the spending is based on the comparison of a few suppliers to bargain the competitive pricing, budget limit checking, and payment procedures. There are some non-profits has formed a benchmark on spending ratio, for example like MyFundAction, we have targeted a ratio of 70% for program expenses, 20% for fundraising activities, and 8% for other operating expenses (payroll and overhead) out of the total collection per month. We will monitor these ratios monthly and always make improvements how to achieve this target.

- Meet the compliance standard locally

Building the trust of the public is a continuous effort that a non-profit should be doing. Like any other non-profit in Malaysia, one should know that the body or person must be registered with the relevant authorities in Malaysia to gather public money for charity. Non-profit can choose to register themselves with Suruhanjaya Syarikat Malaysia (SSM) by forming a Public Company Limited by Guarantee, Registrar of Society (ROS), Bahagian Hal Ehwal Undang-Undang (BHEUU) and Lembaga Hasil Dalam Negeri (LHDN). The non-profit will need to follow these authorities’ procedures, rules, and regulations so that compliance standards are met. For example, there are some compulsory requirements to submit yearly audit reports, convene Annual General Meeting, and submission of tax exemption reports to LHDN for non-profit has complied with.

Lastly, should be any enquires on the above, you can always visit the main websites or by talking to our support team. Let’s start giving today and of course, follow the above tips to give securely to your preferred non-profit.