As an international non-profit organization, MyFundAction operates with a clear governance structure ensuring that every contribution entrusted to us is handled with transparency, accuracy, and full of accountability. With operations that span across multiple countries and jurisdictions, the organization adheres to global standards to meet the standards in handling of all collaborative and crowdfunding-based initiatives.

Our Role in Managing Public Trust

Our responsibility extends beyond receiving donations. We act as professional custodians of funds from individuals, corporations, and community partners who expect not just impact, but integrity. Our approach to fund disbursement reflects this by putting verification and compliance standards at the heart of every transaction.

Our role includes:

- Managing incoming contributions from various channels;

- Verifying partner legitimacy and project viability;

- Ensuring disbursement of funds only upon submission of required documentation.

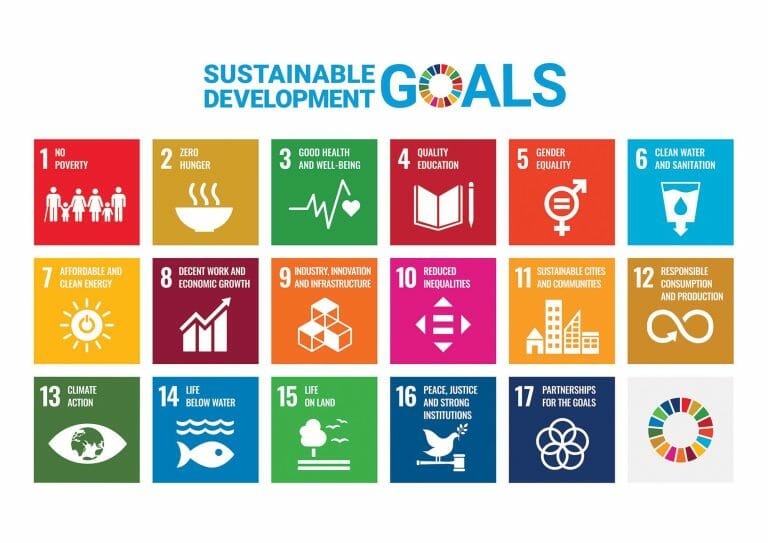

Whether supporting humanitarian aid, infrastructure development, or education campaigns be it local and international; all projects follow the same level of governance. This model protects all parties involved — including supporters, project partners, and financial institutions — from risk, misinterpretation, and regulatory breaches.

The Standard Disbursement Protocol

Before any fund is released for project implementation, MyFundAction requires the following to be submitted by the receiving party:

- Verified invoice(s): Issued by the beneficiary or service provider, indicating purpose and exact figures.

- Progress reports: Especially for staged or milestone-based disbursements.

- Proof of asset ownership or contractual agreement: Applicable for building purchases, rentals, or other asset-based initiatives.

These requirements are not arbitrary. They are component of the company’s compliance system, especially when it comes to overseeing international transactions and making sure every payout complies with audit and legal requirements.

Internal Review and Compliance

All documents submitted undergo a formal internal review by our finance and operations teams. We validate:

- The legitimacy of the receiving party or partner

- Alignment of budget and purpose

- Supporting documents required for international transfers

Our compliance process ensures we meet obligations under anti-money laundering regulations, cross-border fund movement laws, and ethical grant-making standards.

Fund Release and Post-Disbursement Monitoring

Once documentation is verified and reviewed, disbursement is processed through secure banking channels.

Following disbursement, recipients are expected to submit post-fund reports, which may include receipts, progress updates, and financial statements. These reports feed into our internal and external audits.

Why This Process Matters

Operating without documentation invites legal, financial, and reputational into risks. Our structured approach protects the sustainability and credibility of the work we carry out — not just for MyFundAction, but for our global partners.

Commitment to Governance and Compliance

MyFundAction undergoes annual audits by licensed professionals and complies with both local and international financial regulations. All fund management practices are governed by a combination of:

- Internal finance and operations policies;

- Requirements by financial institutions and regulatory bodies.

This disciplined approach ensures that projects are executed not only efficiently but also ethically and legally.

Transparency is not a response to scrutiny — it is a standard that guides every project, every partnership, and every disbursement. – CEO of MyFundAction

To request access or connect with our Governance & Compliance team, please contact: [email protected]